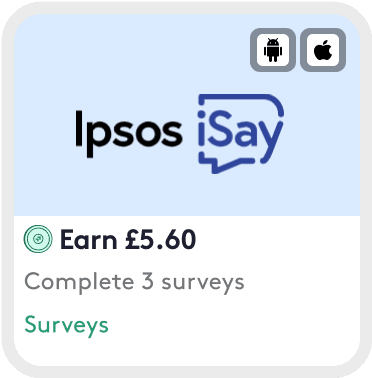

Earn £500+ a month by playing games and answering surveys

Claim £2 on signup

By signing up, I agree to the Terms of Use and accept the Privacy Policy

Already have an account? Sign In.

Withdraw your earnings directly to PayPal, or redeem to Amazon gift cards and more!

Start EarningFAQs

Build your own side hustle 💪

Our drops are tailored to you & your preferences, crafted to boost your income. Grab new earning activities with every drop to keep the money rolling in!

Get paid. Twice. 💰💰

Points to power up how you earn

We match the money boosting activities that work best with you & your situation. Build towards your financial goals & receive ProPoints rewards for making progress.

ProPoints = Extra earnings

- Withdraw for real money: 140pts = £1

- Redeem as in-store vouchers

- Invest to make even more

Earn more whilst you learn 💰🎓

Sharpen your financial skills & create positive money habits with our money academy. Education is usually a cost, but we pay you to learn. Levelling up both your mind & wallet.

How does Prograd work?

The biggest hurdle people face when wanting to make extra cash, is not knowing where to start. Tell us a bit about you & we'll find the best options for you to boost your income & get to your money goals quicker.

Best part... it's free, so let's demystify 'you have to have money to make money'.

STEP 1

STEP 1Tell us a little about yourself.

This helps us understand your situation & recommend the right activities.

STEP 2

STEP 2Grab your drop & learn whilst you earn.

Swipe right on your favourite opportunities & get started earning up to £100 a day!

STEP 3

STEP 3Get rewarded. Twice.

Earn cash from our partner opportunities & ProPoints as an added cash bonus automatically after you have completed the task.

As seen in

Community is everything

We host one of the fastest growing communities for young people to; learn about finance, share their experiences & help each other earn more.Ethan & Marco - Founders @Prograd

We are proud to be part of the community.

Join our community to unlock secret earning opportunities... We help each other out... the more active you are, the more opportunities you unlock.